- The FreightCaviar Newsletter

- Posts

- US Manufacturing Moves Into Expansion After 16 Months of Contraction

US Manufacturing Moves Into Expansion After 16 Months of Contraction

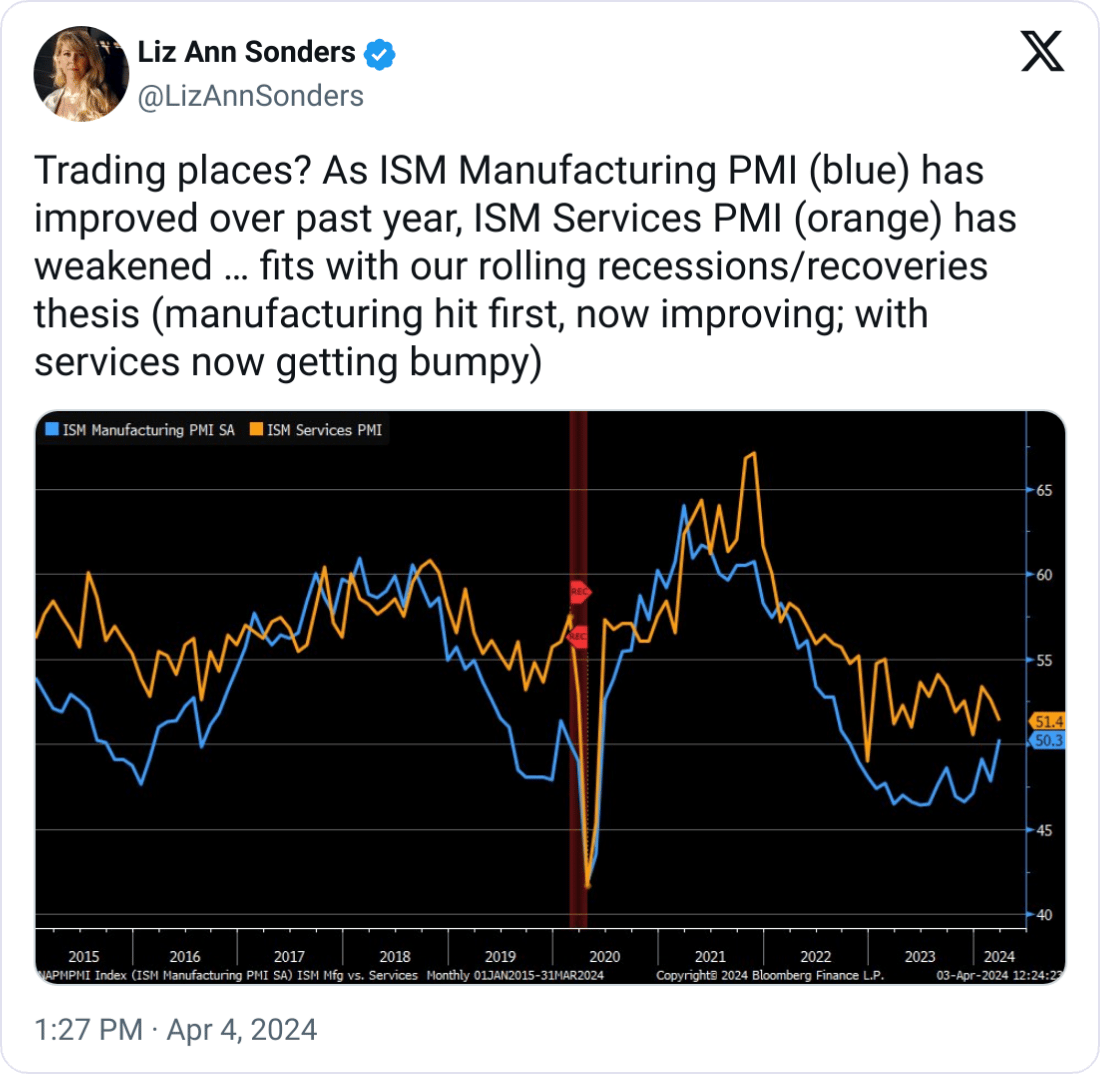

Recent data from the Institute for Supply Management signals a promising shift in the U.S. manufacturing sector:

The index surged to 50.3 in March, marking a move from contraction to expansion.

Production leaped to 54.6, the highest since May 2022.

New orders climbed to 51.4, hinting at sustained momentum.

This rebound from a 16-month slump not only signifies a resurgence in manufacturing activity but also predicts a surge in diesel consumption, closely tied to the freight transport sector's heartbeat.

Post by Liz Ann Sonders, Chief Investment Strategist, Charles Schwab & Co., Inc.

Diesel Dynamics: Navigating Price Fluctuations

The narrative takes a twist as we bring in diesel prices, witnessing a recent dip to $3.996 per gallon. However, this number is a part of a larger, more complex story:

Diesel costs have escalated by 33% since 2019.

Contrastingly, spot rates for freight have only increased by 16%, highlighting a disparity in cost versus income for carriers.

This mismatch underscores a significant challenge, pointing towards an uphill battle for carriers striving to balance rising operational costs against stagnant revenues.

Looking Ahead: Anticipating Market Movements

As the narrative unfolds, the future of freight movement teeters on a delicate balance of supply, demand, and operational efficiencies. Key insights into the road ahead include:

Low diesel inventories coupled with a manufacturing revival suggest tighter fuel supplies and potential price increases.

Global events, like Ukraine's attacks on Russian refineries, could further strain diesel supplies, intensifying the challenges ahead.

Sources: EIA | Reuters | FreightWaves

Sign up for FreightCaviar

The only newsletter you need for freight broker news & entertainment.

No spam. Unsubscribe anytime.

Reply